Introduction: Importance of Understanding Credit Report Items

Understanding the lifespan of negative credit report items is crucial for individuals looking to improve their credit score and financial standing. Your credit report contains detailed information about your credit history, including any negative items that may impact your creditworthiness. By knowing how long these negative items stay on your credit report, you can better plan and strategize to improve your financial health.

Types of Negative Credit Report Items and Their Impact

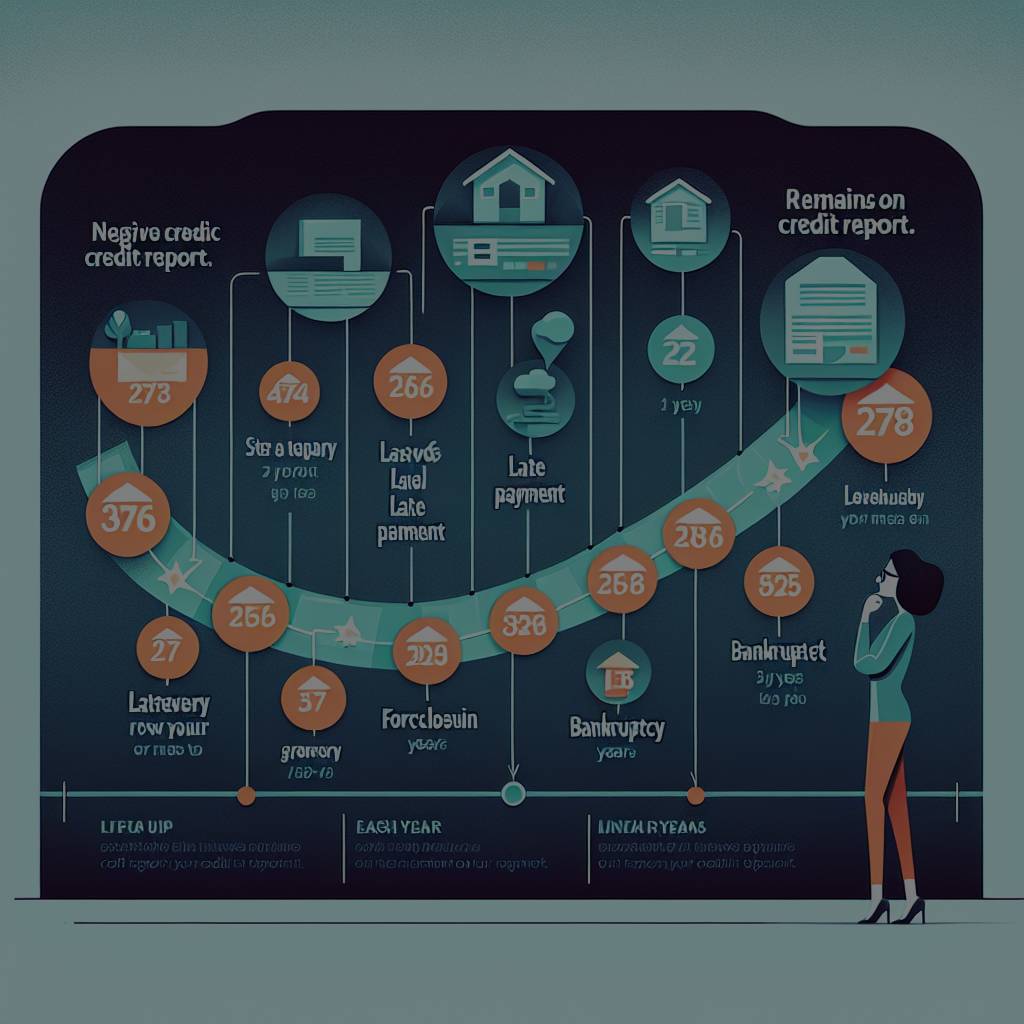

Negative credit report items can include late payments, collections, bankruptcies, foreclosures, and more. These items can have a significant impact on your credit score and make it difficult to obtain credit or loans in the future. Late payments, for example, can stay on your credit report for up to seven years, while bankruptcies can stay on for up to ten years. It’s important to understand the different types of negative items and their specific impact on your credit score.

Lifespan of Negative Credit Report Items: How Long They Stay

The lifespan of negative credit report items varies depending on the type of item. Generally, most negative items can stay on your credit report for seven years. However, more severe items such as bankruptcies can stay on for up to ten years. It’s important to note that the impact of these negative items on your credit score may lessen over time, especially if you continue to make on-time payments and demonstrate responsible financial behavior. Understanding how long negative items stay on your credit report can help you plan for the future and work towards improving your credit score.

Strategies for Managing and Improving Credit Report Items

To manage and improve your credit report items, it’s essential to review your credit report regularly and address any inaccuracies or discrepancies. You can also work on paying off any outstanding debts and making on-time payments to show creditors that you are a responsible borrower. Additionally, consider reaching out to creditors or collection agencies to negotiate repayment plans or settlements to remove negative items from your credit report. By taking proactive steps to manage and improve your credit report items, you can work towards better financial health and a higher credit score.

Understanding the lifespan of negative credit report items is key to improving your financial standing. By knowing how long these items stay on your credit report and implementing strategies to manage and improve them, you can work towards a better credit score and financial future. Stay informed and proactive in managing your credit report items to achieve your financial goals.